Specialty car insurance companies like Hagerty, Grundy, and American Modern offer some of the best coverage for classic, vintage, and other specialty or high-value vehicles. Despite highly-specialized provisions, classic car insurance premiums average about 20–40% less than regular auto insurance policies.

The best car insurance providers for classic car insurance

Insurance rates for classic car coverage usually average between $400 and $1,000 a year, but rates vary significantly due the wide variety of vehicles these policies cover.

Though some major insurance companies offer classic car insurance coverage, many partner with specialty insurers to underwrite their classic coverage policies. To help you sort through the competition, we’ve gathered information on some of the top classic car coverage providers.

| Provider | Why we love it |

|---|---|

| Hagerty | – Unlimited annual mileage – A+ BBB rating and 4.4 stars on Trustpilot – Offers coverage for restoration – projects at all stages – In-house “carcierge” to help you find replacement parts for your vehicle – Underwrites classic car policies for AAA, Allstate, Esurance, Nationwide, and Progressive which increases bundling options |

| Grundy Insurance | – Super-low rates – No mileage limits (as long as each insured driver has another vehicle for general use) – MVP programs for insuring daily drivers – Largest provider of coverage for hot rods and other modified vehicles in the US – Trip interruption coverage |

| Safeco | – A+ BBB rating – Over 50 years of experience – Up to 27 miles per day of unrestricted use with no alternative vehicle requirement – Underwrites classic car policies for Liberty Mutual, which increases bundling options |

| American Modern | – A+ BBB rating – Wide range of coverage options, including unlimited mileage plans – $2,000 in standard spare parts theft or damage coverage (four times the standard $500 coverage offered by most providers) – Inflation guard to ensure full-value coverage as your car increases in value – Underwrites classic car policies for AAA and GEICO, which increases bundling options |

| American Collectors Insurance | – A rating on BBB – 4.9 stars on Trustpilot – Offers coverage for all your collectibles, from antique vehicles to vintage wines – Easy underwriting process – Unlimited mileage plans available – Available C.A.R.E. plans offer a variety of roadside assistance, towing, labor, replacement parts, and spare parts coverages. – Underwrites policies for USAA, which increases bundling options for active military, veterans, and their families who qualify for coverage through USAA |

| Heacock Classic Auto Insurance | – A+ BBB rating – 5.0 stars on Trustpilot – Highly rated by customers for professionalism and competitive pricing – Up to $2,000 in spare parts coverage available – No appraisal required – Policies underwritten by American Modern Insurance |

| State Farm | – One of the few traditional providers that underwrites its own classic and collector car policies, streamlining signup and service, and increasing bundling options – Agents available 24/7 |

Methodology:Our selections for best classic car insurance providers are based on a comparison of top nationwide popular and specialty providers. Insurers selected for recommendation offer the widest options for discounts, coverage and deductible customization, and vehicle usage.

Classic vehicle insurance premiums and deductibles tend to be significantly less expensive than the national average for standard auto insurance policies for similarly-valued vehicles. This is largely thanks to lower risk provided by limited mileage and strict exclusions and eligibility requirements.

Classic car insurance: The basics

Classic or collector car insurance is made to fit the needs of drivers with unique and often high-value vehicles. What qualifies as a classic car will vary by provider, but this umbrella term often applies to everything from antique pickups to modern exotic sports cars.

Classic car insurance protects your vehicle’s value

The single greatest difference between traditional car insurance and classic car insurance is agreed or guaranteed value coverage. Put simply, it’s the appraised value of your vehicle and the amount your insurer guarantees they will pay if your classic car is stolen or deemed a total loss after an accident.

If your car is stolen or totaled in an an accident, a standard car insurance adjuster calculates your vehicle’s actual cash value (ACV) by subtracting depreciation, condition, and mileage from its original price—in other words, the damages you can claim are limited to your vehicle’s market value on the day it was wrecked.

By contrast, a classic car insurance adjuster sends you a check for the amount you and your provider agreed upon at the beginning of your agreement.

Depending on your provider, classic car owners may also have the option to update their car’s value if they get an appraisal, complete restoration work, or add rare parts.

Classic car insurance offers highly-customizable coverage

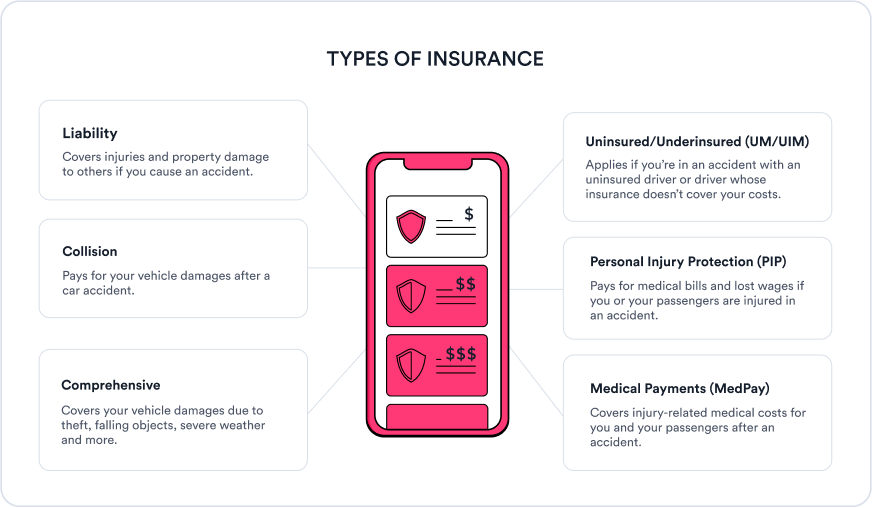

Classic car insurance policies typically offer basic coverage options similar to those you’d find for a regular full-coverage auto insurance policy, including:

Learn more: Types of car insurance—mandatory and optional coverages

But beyond the basics required to meet state insurance laws, classic auto insurance policies are as unique as the vehicles they insure, offering specialized coverage options that aren’t available anywhere else.

Here’s everything you need to know about the types of coverage that may be available with a classic car policy.

| Type of coverage | How it works |

|---|---|

| Cherished salvage coverage | Allows you to keep your totaled vehicle and still get a payout, minus your deductible and the salvage value of the vehicle. |

| Cash settlement option | Allows you to opt for a cash payment without the requirement to repair or replace your vehicle after a total loss. |

| Specialized roadside assistance | All the basic roadside assistance perks, plus guaranteed flatbed transport, or the option to request it at no additional charge. |

| Spare parts, automotive tools, and automobilia coverage | Allows coverage for items lost in a covered event, even if they’re technically not part of your vehicle. |

| No attendance clause | Ensures your vehicle is protected when it’s on display, even if you’re not with it. |

| Auto show medical reimbursement | Coverage for injuries that occur at or on your way to or from a car show. |

| Restoration coverage | Coverage for vehicles throughout the restoration process, often including periodic increases to keep pace with your restoration work, and coverage for tools and parts. |

| Extended mileage | On limited-mileage plans, some providers offer increased mileage to give you more time on the open road. |

Eligibility for classic car insurance

Classic car insurance is designed for rare, collectible, and high-value vehicles. Because these policies can sometimes offer hundreds of thousands of dollars worth of coverage (or more), both the vehicle and driver must meet certain requirements to qualify.

Vehicle eligibility

According to the Classic Car Club of America (CCCA), a classic car is a high-priced, top end limited-quantity vehicle built between 1915 and 1948.1 When you consider that many providers sell classic car insurance policies to cover everything from a retired fire truck to a brand new Ferrari, it becomes clear why the term “classic car insurance” is a bit of a misnomer.

Most providers use this as an umbrella term to cover policies designed for the following types of vehicles:

- Classic cars: Vintage cars and vehicles usually at least 19 to 24 years old, still in good working condition or restored, and average a greater value than other vehicles of the same model year and make.

- Antique cars: A vehicle at least 25 years old and restored or in good working condition.

- Kit cars and replicas: A replica or reproduction of a classic or collector vehicle.

- Modified cars and customs: A vehicle that has been significantly altered from its original condition in a way that could positively, or negatively, affect its value or safety. (e.g. a stock Honda Civic equipped with nitrous oxide or a hot rod Ford Model T.)

- High-performance, exotic, and import cars: Modern muscle cars, exotic cars, imports, and other high-value vehicles of any model year.

- Miscellaneous motor vehicles: motorcycles and scooters, antique and classic tractors, vintage military vehicles.

Additional restrictions may apply!

- Some providers, like Nationwide, require motorists to own a registered regular-use vehicle for commuting and other daily driving to qualify for classic car coverage.

- Many classic car insurance policies require policyholders to store their vehicle in a locked garage or storage unit to be eligible for coverage.

Driver eligibility

In addition to vehicle guidelines, most insurers also have qualifications classic car owners must meet to be eligible for classic car coverage. Typically you must:

- Be at least 25 years old

- Have at least 5–10 years of driving experience

- Have a good driving record with no more than one at-fault accident or moving violation recorded in the previous three years

- Agree not to race your insured vehicle

FAQ

-

Do classic cars cost more to insure?

-

What is the best car insurance for old cars?

-

Does AAA have classic car insurance?

-

How does insurance work on a classic car?

-

How do I ensure my classic car as a daily driver?

-

Why is classic car insurance so cheap?

-

What does classic car insurance cover?

Source

Sarah Gray is an insurance writer with nearly a decade of experience in publishing and writing. Sarah specializes in writing articles that educate car owners and buyers on the full scope of car ownership—from shopping for and buying a new car to scrapping one that’s breathed its last and everything in between. Sarah has authored over 1,500 articles for Jerry on topics ranging from first-time buyer programs to how to get a salvage title for a totaled car. Prior to joining Jerry, Sarah was a full-time professor of English literature and composition with multiple academic writing publications.

Expert insurance writer and editor Amy Bobinger specializes in car repair, car maintenance, and car insurance. Amy is passionate about creating content that helps consumers navigate challenges related to car ownership and achieve financial success in areas relating to cars. Amy has over 10 years of writing and editing experience. After several years as a freelance writer, Amy spent four years as an editing fellow at WikiHow, where she co-authored over 600 articles on topics including car maintenance and home ownership. Since joining Jerry’s editorial team in 2022, Amy has edited over 2,500 articles on car insurance, state driving laws, and car repair and maintenance.