A declarations page is a summary sheet for your car insurance policy that contains essential information about you, your vehicle, and your policy. Policy details from your declarations page can help you file a claim, evaluate your coverage needs, or lower your insurance premiums.

Everything included on a car insurance declaration page

A car insurance declaration page (or “dec page”) is the first page of your insurance policy and contains basic information about your policy, including all the drivers on your car insurance, which vehicles are insured, and how much coverage you purchased.

Jerry’s experts have put together a detailed explanation of what you’ll see on your auto insurance declaration page, how to read it, and more.

For an auto insurance policy, your declarations page should cover at least the following:

- Information about your policy: Your declarations page will outline your policy number, the effective dates of coverage, your auto insurance company, and your agent’s name and contact information, if applicable.

- Who it covers: It should also list the name of the policyholder (or named insured) and other drivers covered under the policy.

- What it covers: You’ll find information for all vehicles covered by the policy on your declarations page, including vehicle identification number (VIN), make, and model.

- How much it covers: All the types of coverage and coverage limits will be listed on your declarations page.

- What you have to pay: You’ll also see information about your expected financial contributions, like any deductibles and premiums for your policy.

Since all of this information is available on a single sheet, it’s a great point of reference for any policy information that you might need, such as your agent’s contact information, your deductible, your agreed-upon premiums, or your coverage limits.1

How to read a car insurance declaration page

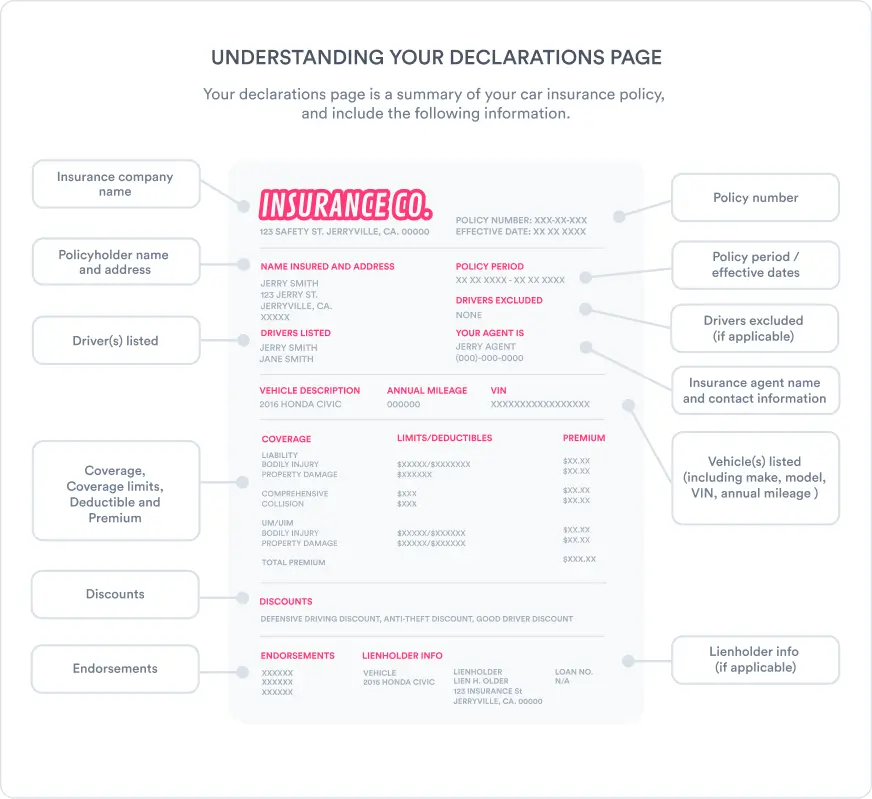

To help you better understand the information on your auto insurance declarations page, the expert insurance team at Jerry created this mock page example.

At the top of the page, you’ll see your policy number and the effective dates of your policy—that is, the start and expiration date of your policy period. As you move down the page, you’ll also see information about the policyholder, other covered or excluded drivers, your insurance agent, your coverage limits, your premiums, and any deductibles.

Following that, you may also see additional information, such as:

- Discounts: If you have a discount on your policy—such as for bundling your auto and home insurance or renters insurance policy—it will show up on your declarations page.

- Lienholder information: If your car is financed or leased, the lender’s information will be included on your declarations page as a loss payee.

- Endorsements and exclusions: In addition to your policy’s limits and types of coverage, the policy declarations page will list any excluded perils or coverage add-ons that apply.

Not all auto insurance declarations pages are formatted the same, but they should include all applicable information.

How to get a copy of your declaration page

When you purchase car insurance, you should receive a copy of your policy. The insurance declarations page will usually be the cover sheet for your policy, meaning it’s the first page you’ll see.

If you need a new declarations page, you can request one from your auto insurance provider by calling, visiting their website, or using their mobile app. Another solution is to use the Jerry app. If you purchase a policy with Jerry, you can find your declarations page and any other important policy information in the app’s virtual glovebox.

A declaration page can count as proof of insurance

While a car insurance declarations page can be an acceptable proof of insurance when you’re purchasing a vehicle, you shouldn’t rely on this document as your sole proof of insurance—especially if you’re pulled over by law enforcement.

Your car insurance ID card, which comes along with your declarations page when you purchase a new policy, is the best form of proof of insurance. Other acceptable types of proof of car insurance include:

- A digital insurance ID card

- A proof-of-coverage letter or certificate of insurance from your insurance company

- An SR-22 or FR-44 filing, which proves that a high-risk driver has the required amount of car insurance coverage in their state

Without one of these official documents, you risk getting into legal trouble during a traffic stop. You should always keep a copy of your digital ID in your car’s glove compartment. Or, if you use Jerry, it can be found directly in the app.

FAQ

FAQ

-

Do bundled insurance policies have two declarations pages?

-

How can I obtain a copy of my auto insurance declaration page?

-

What are the parts of a declaration page?

-

Is an insurance declaration page the same as a binder?

-

What is a car insurance premium?

Source

Liz Jenson is an insurance writer who specializes in general automotive and insurance topics. Liz’s mission is to produce informative and useful content to help car owners make smart choices when buying cars and car insurance. Since joining Jerry in 2021, Liz has written nearly 4,000 long- and short-form articles on topics including state-specific insurance recommendations, common car insurance questions, and deep dives into vehicle model details. Before they came to Jerry, Liz was a full-time student at Indiana University, Bloomington working on a double major in English and French.

Kianna Walpole is an insurance writer and editor with a comprehensive background in consumer behavior and online publishing. With experience in car insurance, maintenance, and repair, she is dedicated to building informative content that helps customers reduce costs while achieving the best service. Prior to joining the Jerry editorial team, Kianna worked as a junior editor in the content marketing industry, using consumer data and key insights to create and edit content for an array of large-scale clients in the real estate, cybersecurity, and healthcare industries.