Insurance companies provide a physical or digital card that will serve as proof of car insurance. If you can’t prove that you have coverage, you could be ticketed and fined.

What is proof of insurance?

Proof of insurance is evidence that you hold a valid and current insurance policy that covers both you and the vehicle. This ID card shows info related to you and your policy, and it helps police officers and car dealerships verify your coverage quickly.

If you recently purchased or renewed a car insurance policy, you might receive a temporary digital insurance card to use until the hard copy arrives in the mail. If you do not receive your proof of insurance, make sure you reach out to your insurance company to get the appropriate documentation.

Keep it safe and accessible: Insurance companies usually issue two cards per vehicle, so you can keep one card in the vehicle at all times.

Switch it out every renewal: Every time your policy renews, you will receive an updated proof of insurance. Once the new card arrives, shred and throw out your old card and put the new one in your vehicle so you can prove that your insurance is up to date.

All about your insurance card—and what it includes

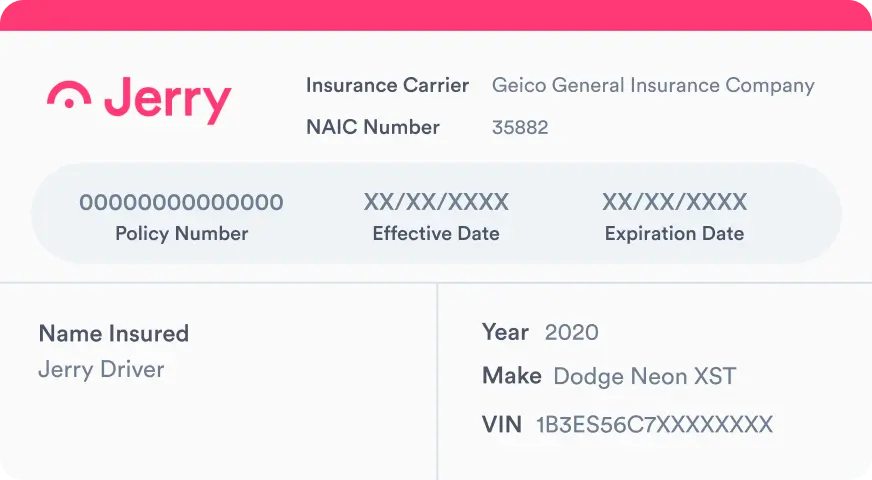

An insurance card usually shows the name of the insurance company plus information about you, your vehicle, and your policy.

Here’s the information normally included in a proof of insurance card or document:

- Driver info: Full name of all covered drivers (sometimes address)

- Vehicle info: Vehicle year and make, vehicle identification number (VIN)

- Policy info: Name of insurance company, effective date, expiration date, policy number

In most cases, an insurance ID card with all of this information will qualify as proof of insurance. However, some lenders or leasing agents may require you to prove that you’re carrying full coverage. In these cases, you might need to produce the full declarations page, which includes more information about the types of coverage and policy limits you carry.

How to show proof of insurance

One option is to show proof of insurance on a printed car insurance card from your insurance company. This is accepted in all 50 states.

Another option is to pull up an electronic version from your insurance company’s mobile app. Digital proof of insurance is accepted in 49 states and Washington, D.C., but New Mexico does not require law enforcement to accept an electronic copy of an insurance card.

You can also show proof of insurance digitally via the Jerry app. Users can find their insurance ID card on the homescreen of the app, so you won’t have to search for the information you need.

How to get instant proof of insurance

If you have the physical card in your possession, just pull it out of your glove compartment and show it to the officer.

If you do not have a physical card but you need to immediately show proof of coverage, you have two options:

- Go into your email inbox: You should have been sent a digital insurance card when you originally purchased the policy.

- Download your insurer’s mobile app: You can instantly find proof of insurance in the mobile app after creating an account.

- Use Jerry: With the Jerry app, proof of insurance is just a few clicks away on your smartphone.

To find the full coverage amounts and types of coverage in your policy, go online or call your agent.

Which states allow digital proof of insurance?

In 49 states, it’s legal to show digital proof of insurance—the exception is New Mexico, where the Motor Vehicle Division1 states that police are not required to accept electronic proof of coverage.

There are two states that don’t fit neatly into “allowed” and “not allowed” categories.

- Massachusetts: In MA, your insurance information is already printed on your car registration. You should always have your registration in the car, so there’s no need to carry a separate insurance ID document.

- New Hampshire: Car insurance is not mandatory for all drivers in New Hampshire (but it is the simplest way to demonstrate financial responsibility), so this state has no laws about showing digital proof of coverage.

Learn more: What is temporary car insurance? Do I need it?

Why and when you need proof of insurance

Because car insurance is legally required in nearly every state, you need to be able to prove that you have coverage whenever you drive your vehicle.

- In case of car accident: In a car accident, having your proof of car insurance on hand allows you and the other party to exchange information and understand what might be covered.

- In case you get pulled over: If you get pulled over for a moving violation, you will need to show the officer proof of insurance. Otherwise, you could be ticketed for the traffic violation as well as for the lack of insurance.

- At the DMV: You will need to show proof of insurance at the DMV when you renew your license plate or register a new vehicle.

- All the time: It’s wise to maintain insurance coverage even if you don’t own a vehicle or aren’t driving frequently. A gap or lapse in coverage may cause companies to view you as a high-risk driver, which can increase your premiums.

Learn more: Standard types of car insurance

Penalties if you’re caught without proof of insurance—and you’re not insured

If you cannot show proof of insurance, you will be treated as if you are driving without insurance. For example, if you are stopped by police and don’t have proof of insurance with you, then the officer can write you a ticket.

Failure to provide proof of insurance is a completely different offense than driving an uninsured vehicle.

Driving without insurance is a far more serious offense. It can result in fines, license suspension or revocation, vehicle impoundment, license reinstatement fees, and even jail time. It can also trigger higher rates for auto insurance. Here’s an example of the kind of increased monthly premiums drivers face after being ticketed for driving without insurance.

| Provider | Before lapse | After lapse | Percent increase |

|---|---|---|---|

| AAA | $160 | $211 | 32% |

| Allstate | $142 | $154 | 8% |

| GEICO | $225 | $364 | 62% |

| Nationwide | $108 | $175 | 62% |

| Progressive | $129 | $173 | 34% |

| Travelers | $100 | $146 | 46% |

The exact consequences of driving without insurance depend on your state’s laws. Visit your state’s Department of Motor Vehicles website for information about its minimum insurance requirements and the penalties for not having proof of insurance.

What if I don’t have proof of insurance, but I am insured?

If you’re ticketed because you can’t prove you’re covered, you can contest the ticket later if you did have coverage at the time. Respond to the correspondence immediately so the state does not revoke or suspend your license.

Generally, you can contest a ticket in one of two ways:

- Mailing a copy of your proof of insurance

- Attending the court hearing with proof that you were insured on the date the officer pulled you over

While the charges could be dismissed, you may still have to pay a fine and/or court fees. In rare cases, the insurance company might have made a mistake in reporting your insurance coverage to the state.

Many states use an electronic insurance verification system to identify uninsured drivers, where they match your vehicle registration with your insurance records. If they don’t match, it will appear as though you do not have coverage and you’ll be reported to the DMV for administrative action. To fix this, contact your insurer right away to have the information corrected and resubmitted.

FAQ

-

Does NY accept electronic proof of insurance?

-

What states do not allow electronic proof of insurance?

-

Does NJ accept digital insurance cards?

-

Can I have a car without insurance and not drive it in NY?

-

Is it okay to have proof of insurance on your phone?

-

What is considered proof of coverage?

Source

Liz Jenson is an insurance writer who specializes in general automotive and insurance topics. Liz’s mission is to produce informative and useful content to help car owners make smart choices when buying cars and car insurance. Since joining Jerry in 2021, Liz has written nearly 4,000 long- and short-form articles on topics including state-specific insurance recommendations, common car insurance questions, and deep dives into vehicle model details. Before they came to Jerry, Liz was a full-time student at Indiana University, Bloomington working on a double major in English and French.

Sarah Gray is an insurance writer with nearly a decade of experience in publishing and writing. Sarah specializes in writing articles that educate car owners and buyers on the full scope of car ownership—from shopping for and buying a new car to scrapping one that’s breathed its last and everything in between. Sarah has authored over 1,500 articles for Jerry on topics ranging from first-time buyer programs to how to get a salvage title for a totaled car. Prior to joining Jerry, Sarah was a full-time professor of English literature and composition with multiple academic writing publications.